"What If Something Happens to Me?"

THE QUESTION MOST PEOPLE AVOID ASKING

Nobody wants to think about it. Disability. Critical illness. Premature death. Long-term care needs.

But here's the truth: these things happen. And when they do, they don't just affect you - they affect everyone who depends on you.

If you're the primary income earner and you can't work, how will your family pay the mortgage? Cover the bills? Fund your kids' education? If you pass away unexpectedly, will your spouse have to sell the house? Go back to work? Give up the retirement you both planned for?

These aren't pleasant questions. But they're necessary ones.

Because the best time to protect against these risks is before they happen - not after.

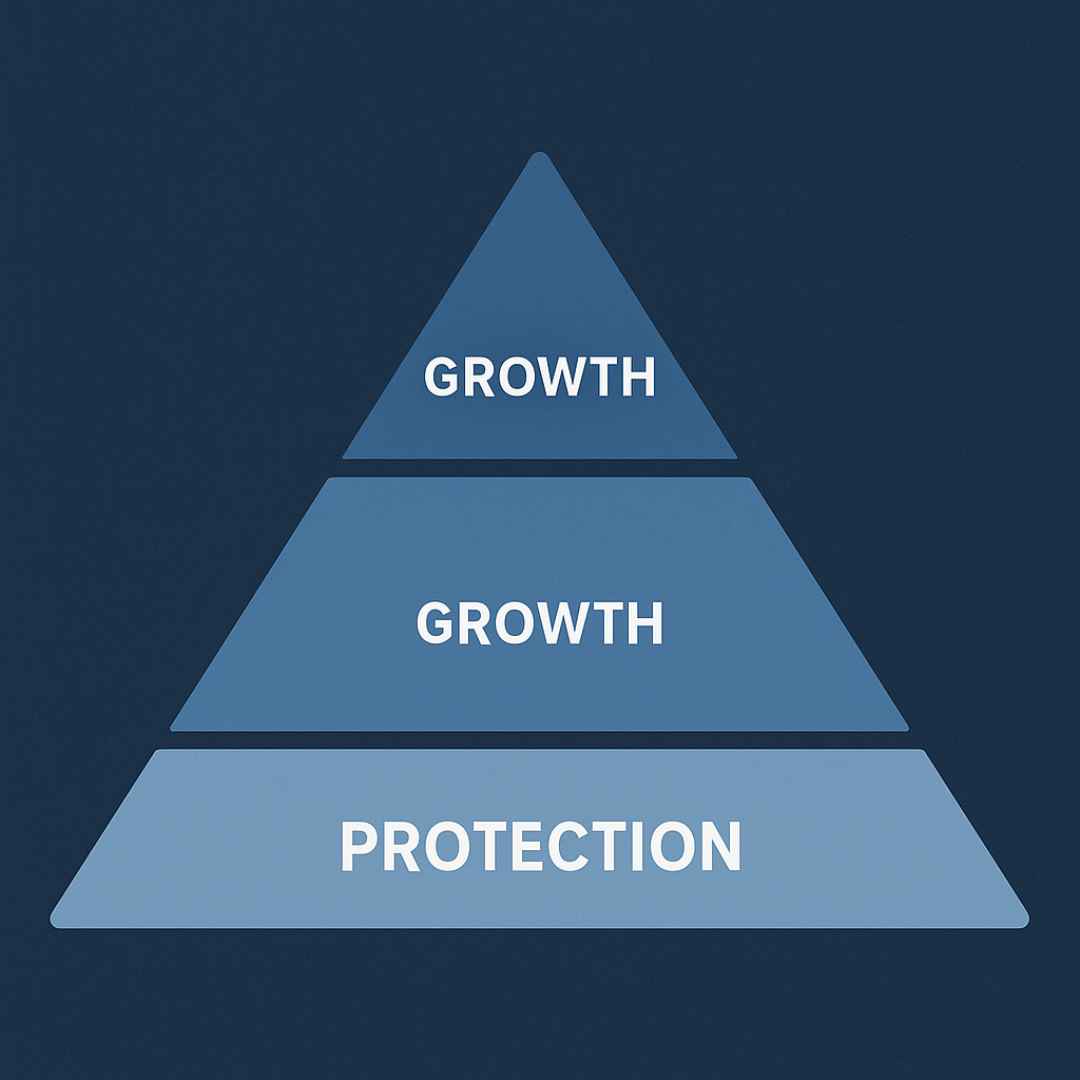

WHY PROTECTION COMES BEFORE GROWTH

Most Advisors Start With Investments. We Start With Protection.

Here's how most financial advisors approach planning: they want to talk about growing your wealth. Investment returns. Portfolio allocation. How to maximize your assets.

That's backwards.

What good is a great investment strategy if a single health event wipes it all out? What's the point of saving for retirement if your family loses the house because you couldn't work for six months?

At TrueClarity Wealth, we start with protection planning. It's one of the two foundational pieces of every financial plan we build (along with cash flow).

Why? Because you can't build wealth if you're not protecting what you already have.

Once we've addressed the "what if" scenarios - once we know your income, your family, and your lifestyle are protected - then we focus on growth. But not before.

04

Health Insurance: Covering the Basics (and the Gaps)

If you're under 65, health insurance is non-negotiable. But having insurance isn't enough - you need the right insurance.

We review your current coverage to make sure it actually protects you. Questions we address:

Are your premiums, deductibles, and out-of-pocket maximums manageable?

Does your plan cover the doctors and specialists you need?

If you're self-employed or a business owner, are you overpaying for coverage?

Are there gaps in your coverage that could leave you exposed?

For business owners, we also help you evaluate employee health benefits and how they fit into your overall compensation strategy.

05

Medicare Insurance: Navigating the Maze

Once you hit 65, Medicare becomes your primary health insurance. But here's the catch: Medicare doesn't cover everything. And the choices you make during enrollment can have long-term financial consequences.

We help you understand:

The difference between Original Medicare, Medicare Advantage, and Medigap

When and how to enroll (missing deadlines can cost you)

Which Part D prescription drug plan makes sense for your medications

How to avoid penalties and maximize your coverage

Medicare is confusing. We simplify it and make sure you're not leaving money on the table - or paying for coverage you don't need.

I worked with a couple in their late 30s - both high earners, two young kids, a nice house, solid savings. On paper, they looked great.

But when we dug into their protection planning, we found a major gap: the husband had minimal life insurance through his employer (about one year's salary), and no disability coverage at all.

He was the primary breadwinner. If something happened to him, his wife would have to sell the house, drain their retirement savings, and go back to work full-time - while raising two kids alone.

That wasn't a risk they were willing to take.

We put together a term life insurance policy that would replace his income for 20 years and cover all their debts. We also secured a disability policy that would pay 60% of his income if he couldn't work.

Two years later, he was diagnosed with a serious illness that kept him out of work for eight months.

The disability policy kicked in. It covered their bills, their mortgage, their kids' activities - everything. They didn't have to touch their savings. They didn't have to make any lifestyle sacrifices. The plan held.

That's what protection planning is about. Not selling insurance, but making sure your family is okay when life doesn't go according to plan.

There is no guarantee that the results of these individuals will be obtained in the future.