"What Happens to Everything When I'm Gone?"

THE CONVERSATION NOBODY WANTS TO HAVE

It's not a comfortable topic. But it's one of the most important conversations you'll ever have.

Because here's the reality: if you don't make decisions about your estate, someone else will. And it probably won't be the way you would have wanted.

Without a plan, your family could face:

bate court (which is expensive, time-consuming, and public)

Hefty estate taxes that eat away at what you wanted to leave behind

Family conflict over who gets what

Assets tied up for months or years while the courts sort it out

Estate planning isn't about being morbid. It's about being responsible.

It's about making sure your family is taken care of. That your assets go where you want them to go. And that you're not leaving a mess for the people you love to clean up while they're grieving.

WHAT ESTATE PLANNING ACTUALLY MEANS

It's Not Just for the Wealthy

A lot of people think estate planning is only for the ultra-rich. That's not true.

If you own a home, have retirement accounts, have life insurance, or have minor children - you need an estate plan.

Estate planning isn't just about distributing assets. It's about:

Naming guardians for your children if something happens to you

Avoiding probate so your family doesn't have to deal with the courts

Minimizing taxes so more of your wealth goes to your family instead of the IRS

Protecting your assets from creditors and lawsuits

Making sure your healthcare and financial wishes are honored if you're incapacitated

It's about control. If you don't have a plan, the state decides what happens. If you do have a plan, you decide.

01

Identify Your Potential Estate Net Worth and Liquidity

First, we need to understand what you actually have.

We calculate your total estate value - everything you own: your home, retirement accounts, investment accounts, life insurance proceeds, business interests, and any other assets.

Then we look at liquidity. If something happened to you tomorrow, would your family have access to cash to pay bills, cover funeral expenses, and handle immediate needs? Or would everything be tied up in illiquid assets like real estate or retirement accounts?

This gives us a clear picture of where you stand today and whether your current plan (or lack of one) will actually work for your family.

02

Analyze Tax Planning Strategies to Optimize Your Financial Position

Estate taxes can take a massive bite out of what you leave behind. Depending on the size of your estate and how it's structured, your heirs could lose a significant portion to taxes.

We explore strategies to minimize that burden:

Gifting strategies to reduce the size of your taxable estate while you're still alive

Trusts that can protect assets and provide tax benefits

Roth conversions and other tax-advantaged moves that benefit your heirs

Charitable giving strategies if philanthropy is important to you

The goal is to make sure as much as possible goes to the people and causes you care about - and as little as possible goes to the government.

03

Coordinate with Your Estate Planning Attorney

Here's something important to understand: I'm not an attorney, and I can't draft legal documents like wills, trusts, or powers of attorney.

What I can do is work alongside your estate planning attorney to make sure your financial plan and your legal documents are aligned.

I'll help you understand the financial implications of different strategies. I'll make sure your beneficiary designations match your overall estate plan. I'll identify gaps or opportunities your attorney should know about.

And if you don't have an estate planning attorney, I can refer you to trusted professionals who specialize in this area.

Estate planning works best when your financial advisor and your attorney are working together, not in silos.

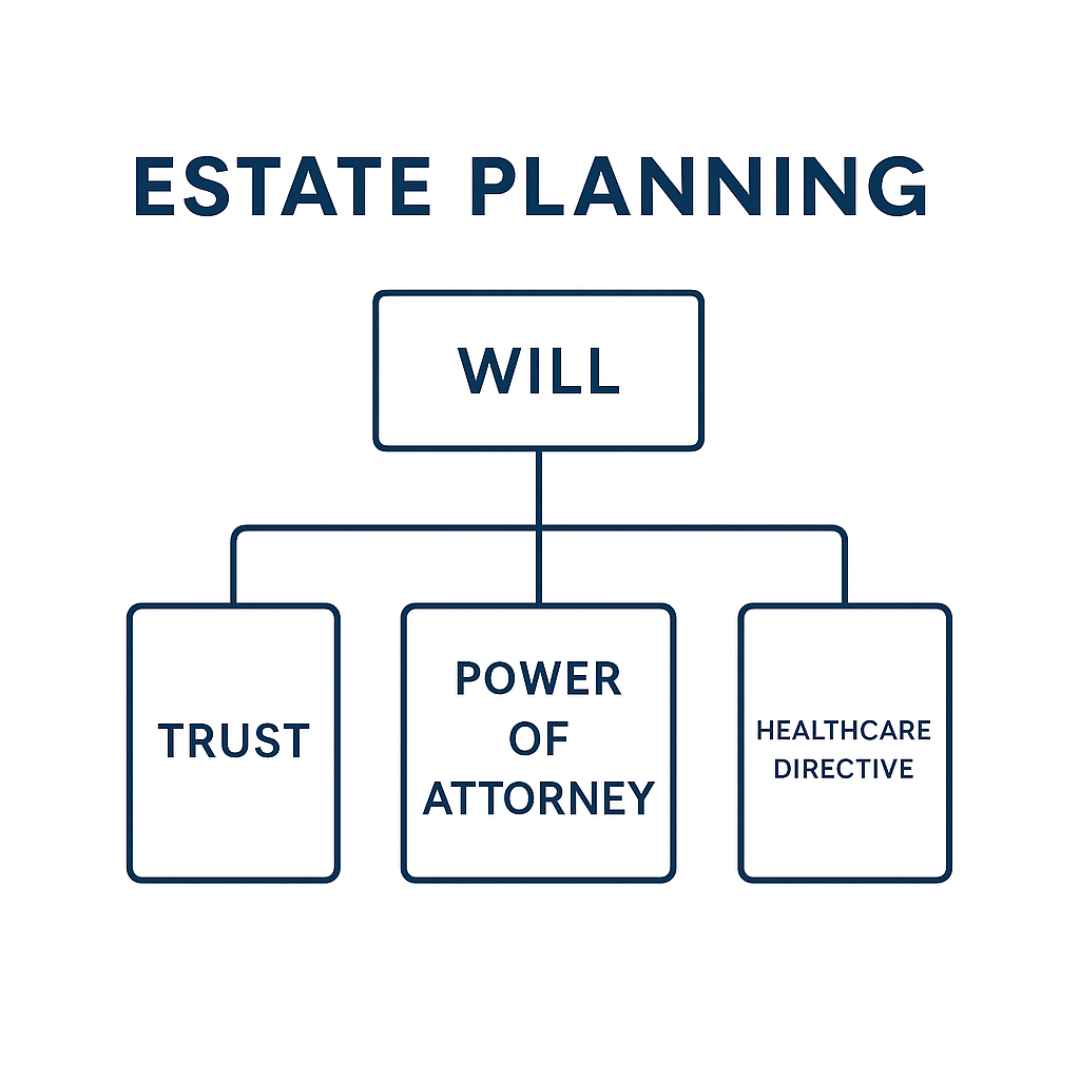

Last Will and Testament

Your will specifies who gets your assets, who manages your estate, and who takes care of your minor children. Without one, state law decides.

Revocable Living Trust (if appropriate)

A trust can help you avoid probate, maintain privacy, and control how and when your assets are distributed. Not everyone needs a trust, but for many families, it's the right move.

Financial Power of Attorney

This document names someone to manage your financial affairs if you're unable to do so. Without it, your family may need to go to court to access your accounts.

Healthcare Power of Attorney and Living Will

These documents specify your medical wishes and name someone to make healthcare decisions on your behalf if you can't. They ensure your family isn't left guessing about what you would have wanted.

Beneficiary Designations

Your retirement accounts, life insurance, and certain other assets pass directly to named beneficiaries. We review these regularly to make sure they're up to date and aligned with your overall plan.

I worked with a pre-retiree couple who had done a great job saving for retirement. They had large balances in traditional IRAs and were planning to just let that money grow, touch it as little as possible, and pass it to their kids.

On the surface, that sounds smart. But when we ran the numbers, we uncovered a major problem.

By the time Required Minimum Distributions kicked in at age 73, their IRA balances would have more than doubled. They'd be forced to take massive withdrawals every year, pushing them into the 24% tax bracket. And if one spouse passed away, the surviving spouse would be filing as single - with even higher taxes.

But here's where it gets worse for their kids: when they inherited those IRAs, they'd owe income taxes on every dollar they withdrew. With the SECURE Act rules, they'd have to drain the accounts within 10 years - likely during their peak earning years - which could push them into the highest tax brackets.

So instead of letting the problem compound, we built a proactive plan.

There is no guarantee that the results of these individuals will be obtained in the future.

We started converting money from their traditional IRAs to Roth IRAs over several years - during their lower-income window before RMDs kicked in. This reduced the size of their pre-tax accounts, which meant smaller future RMDs and lower taxes.

The result?

Over $150,000 in projected tax savings for the couple during their lifetime. And when they pass, their kids will inherit Roth accounts - meaning tax-free withdrawals and an extra $600,000 in their estate that won't be eroded by taxes.

That's the power of proactive estate planning. It's not just about documents, it's about strategy.